Plans to build thousands of council homes in Haringey face delays as inflation and higher borrowing costs hammer the construction sector.

The local authority’s housebuilding programme faces a “high degree of financial risk”, which is being partly caused by the Government’s “catastrophic” management of the economy, according to one senior councillor.

Haringey Council aims to build 3,000 council homes by 2032 after beginning an extensive housebuilding programme in 2018. A report presented to the council’s housing and regeneration scrutiny panel on Thursday reveals 1,503 homes now have planning permission and 1,444 have started on site.

But the report adds that the cost of building materials has soared and public sector borrowing rates have jumped from 1.26 per cent to almost 4 per cent in less than a year. As a result, the council is forecast to borrow £534.8 million over the next five years to finance its programme.

The volatile economic conditions are causing delays as contractors seek to renegotiate their bids, which puts at risk time-limited grant funding from the Greater London Authority.

Cllr Ruth Gordon, cabinet member for council housebuilding, placemaking and development, told the panel meeting that the council had faced a “really difficult financial situation” for some time, which was being exacerbated by the Government’s “catastrophic” management of the economy.

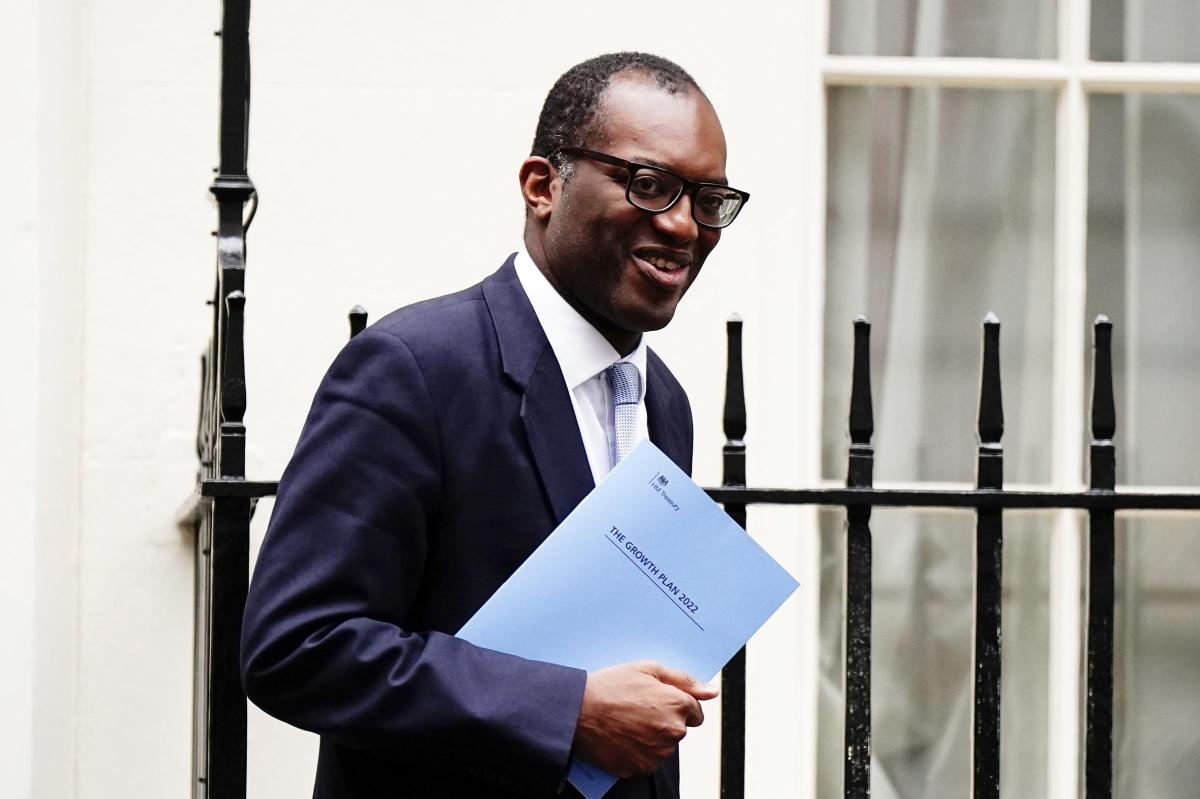

Her comments followed a so-called ‘mini-budget’ announced by Chancellor of the Exchequer Kwasi Kwarteng last month, which sparked a fall in the value of the pound and stoked fears that interest rates would have to rise to offset inflation.

Cllr Gordon said: “The budget has thrown Britain’s economic system into disarray. It is quite scary now, especially where we are in a position where we are trying to borrow money, and that borrowing is becoming more and more expensive.”

Cllr Gordon warned there was now a “high degree of financial risk” within the council housebuilding programme, and officers were monitoring the situation.

The report presented to the panel reveals two firms on council developments went into administration during the previous quarter, and the authority is monitoring the finances of other contractors that could be at risk.

Labour panel member Khaled Moyeed asked whether more companies were likely to go into administration because of the economic volatility.

Robbie Erbmann, the council’s assistant director for housing, said the firms that went into administration were subcontractors, and none of the main contractors used by the council had been similarly affected. He explained that the council pays as construction work is carried out and uses fixed-price contracts to protect its finances, although he acknowledged that because of the “highly volatile market” there may be a risk of the council losing money on some projects.

Under questioning from panel chair Matt White, Cllr Gordon did not rule out having to introduce other types of tenures into the housebuilding programme in addition to social rent because of the economic conditions. She added that public-sector borrowing rates were likely to rise beyond 4 per cent following the Government’s recent actions.

Cllr Gordon continued: “Just as every individual who has got a mortgage is worried about that, obviously when we are talking about the many multiple millions we are borrowing to finance our programme, that is a big question for the council.”

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules here